Oyuna (name changed), 43, is a single mother of six who lives in Mongolia. Not long ago, due to an extremely challenging economic environment that limits employment options for women, the only way to feed her family was to engage in sex work. She did this for 14 years while also taking on odd jobs such as washing cars, growing vegetables and making clothes.

Over the years, Oyuna had developed an alcohol dependency. She would drink before meeting clients, or when depressed about having so few choices about how to make a living.

But then a friend told Oyuna about a program called Undarga and said it might give her another way to make and save money.

Thinking this might be her last opportunity to “turn my life around,” Oyuna enrolled in Undarga and was randomly assigned to the microfinance condition: learning skills to develop a business and receiving a 2-to-1 match for women’s own savings—which builds assets. She developed and implemented a business plan to raise pigs. With her matched savings, she bought an in-calf sow for breeding and selling. The friend who sold her the sow threw in the gift of a piglet as well.

Pretty soon, Oyuna was on the road to making and saving money.

Structural forms of prevention needed

Oyuna was one of over a hundred participants in a study led by Dr. Susan Witte of the Columbia School of Social Work. Her research team included Dr. Toivgoo Aira from the Global Health Research Center for Central Asia and Drs. Marion Riedel, Fred Ssewemala and Nabila El-Bassel, all from CSSW. They were testing an intervention designed to reduce the risk of HIV infection among Mongolian women who engage in street-based sex work.

“Women engaged in sex work represent one of the remaining highest risk populations for HIV globally, Dr. Witte explains. “For these women, we need to address not only traditional, individually based forms of prevention, such as condom use, but also those which may increase options for alternative employment or income—what we would call structural forms of prevention.”

She further noted that, although Mongolia currently has an HIV prevalence rate of less than 0.1 percent, treating the population of women who engage in sex work is crucial if Mongolia is to avoid the fate of its neighboring countries, Russia and China, in developing a full-blown HIV epidemic.

Already, there are high rates of other sexually transmitted infections (STIs) and alcohol dependence in the general population—known to be cofactors associated with emerging HIV epidemics.

Savings-led microfinance

Dr. Witte and her research team published their findings in the January issue of the American Journal of Public Health. As the first study to test a microfinance intervention on behalf of women engaged in sex work, it showed that for such interventions to be effective in a low-income country like Mongolia, it is crucial to provide the tools for finding income alternatives and then building up assets through savings. Go to article; download article PDF (8 pages).

Unique about the study was its emphasis on saving money—there was no microloans component. Researchers felt that in a country where there is insufficient regulation or oversight of microlending, microloans could put the women in the study at greater risk. Significantly, no adverse events were reported during the study related to increases in violence associated with an accumulation of assets or participation in a microfinance program.

“The success of this work comes from a strong, committed team who have been incredibly creative in their ability to listen carefully to the women in the community and to blend the articulated needs of the women with whom we are working with the best evidence interventions and research methods available,” Dr. Witte says. “We are proud of this work and have already begun to expand applications of the intervention to other parts of the Central and East Asia region, including a new NIDA-funded project in Kazakhstan.”

A new chapter for Oyuna?

New Study: Savings-led Microfinance Reduces HIV Risk for Vulnerable Women in Mongolia

So, what happened to Oyuna? She completed the study back in 2012 but visited the local office two years later to report that she now had 60 pigs and her farming efforts have continued to grow.

One of the most active participants in Undarga, saving one of the largest amounts of money, she told Dr. Toivgoo:

Record keeping and daily household budgeting has become my habit like brushing my teeth in the morning and the evening. While raising my children I often used to feel lonely and drink alcohol, but now my life has changed and there are people who support me in the Undarga project. Therefore, I’m very confident about myself. I’m grateful to Undarga.

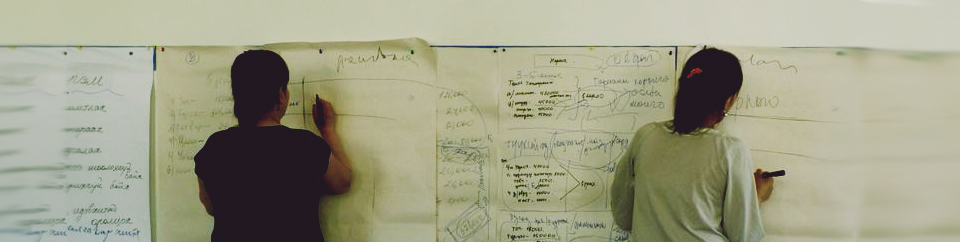

Image: A woman in the Undarga program works out a new business budget with supportive mentorship. Credit: Susan S. Witte.

Related Links:

- SWM014: Marking 10 Years of Health Research in Central Asia, with Louisa Gilbert and Angela Aifah (December 2014 podcast)

- Talking to Professor Nabila El-Bassel about Setting, and Stepping Up, the Pace of AIDS Intervention (July 2014 interview)

- Nabila El-Bassel Guest-Edits Journal Special Issue on AIDS in Central Asia (December 2013 news release)

– See more at: http://socialwork.columbia.edu/news-events/new-study-savings-led-microfinance-reduces-hiv-risk-vulnerable-women-mongolia#sthash.DcFCjWlp.dpuf

Connect with us