The pandemic has put almost everyone into the gutter. The unpredictability of the global economy led to shutdowns and unemployment. The disruptions in the supply chain and the limited operations made things worse. But, hope floated as businesses and consumers found various ways to meet demands in the market.

In the last year, business transactions rose as cashless payments emerged. Even in emerging markets, online banking and e-wallets have become a staple. The growth prospects of the fintech industry have also become auspicious.

With that said, let’s take on the topic of virtual credit cards (VCCs). Also, let’s see how they will continue to take the lead in the future.

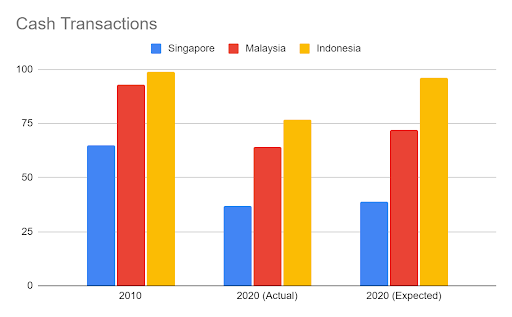

The Decline of Cash Transactions in the Asia Pacific

Over the past decade, cash transactions plummeted in the region. It became more evident at the height of the pandemic. For example, Singapore’s cash transactions dropped to 37% compared to 65% in 2010. The same scenario could be seen in Malaysia and Indonesia at 64% and 77%, respectively. The percentage was lower than what the Strait Times expected.

Likewise, payment systems went through headwinds amidst the disruptions of the global economy. The increased scrutiny in banking fees did not help banks weather the stormy market. Yet, it was only an initial shock that the fintech industry brushed off for the following months. Now, it is in an excellent position to diversify and revamp payment methods.

A perfect manifestation of it is the exponential increase in cashless transactions. It is more evident in North America and the Asia Pacific region.

The Rise in Virtual Credit Cards

The world is turning to virtual credit cards and other contactless payments. From personal to business purposes, they had a higher demand in 2020. It was driven mainly by e-commerce and increased access to banking services. Given its popularity, virtual card transactions may reach $6.8 trillion in 2026. Here are the current trends that make VCCs a prevalent payment method.

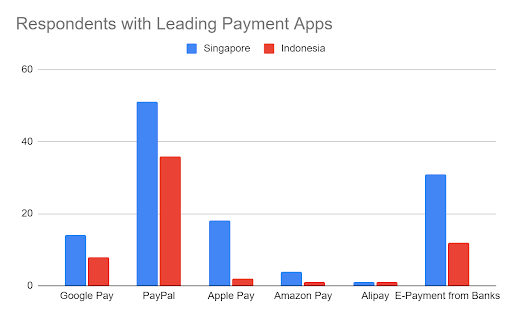

The Prevalence of Online Payment Apps

Virtual credit cards are a response to the prevalence of payment apps like Apple Pay and Paypal. These apps enable one to use VCCs since they require a linked credit card to pay or send money. In Singapore, over 50% of the respondents in a 2020 survey were PayPal users. Meanwhile, 31% had bank e-wallets, and 14% had Google Pay. A similar trend can also be seen in Indonesia. These make VCCs more convenient since users can transact even without a physical card.

VCCs for a Convenient and Fraud-Free Transaction

VCC owners do not have to bring their physical cards when shopping in malls and supermarkets. It is the same with shopping online. They will get a number to proceed with the transaction. In that way, they will not have to swipe or wave their cards at the biller.

These can help them avert data breaches, fraud, and scams. This is thanks to the VCC number that limits consumers’ information. Once done, the seller can only see the number used, nothing else.

VCCs for Increased Savings

Users find VCCs an effective way to limit their spending. They can freeze their cards whenever they wish to. They may also set a spending limit and a date for the VCC number to close. Since the VCC can be used once or twice, it will close immediately after the payment. Hence, they manage their budget to save more.

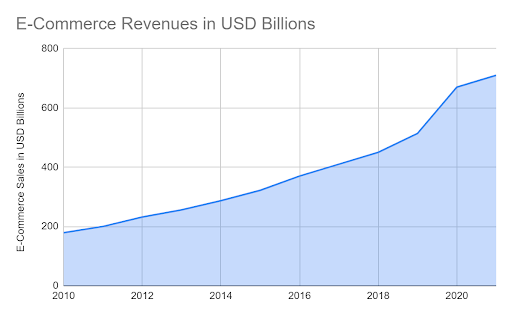

The Expansion of E-Commerce

The rise in the e-commerce industry has had a positive impact on virtual credit cards. It is one of the main VCC growth drivers since most payments are made online. From 2010-2019, it had almost steady revenue growth, reaching $514 billion. In 2020, it amounted to $670 billion, a 30% increase in a single year as more people went online. As of November 2021, the YTD revenues were set at $720 billion.

It may expand further as the digital revolution continues. Now, e-commerce covers a broad range of markets globally. Given the trend, the volume of payments through VCCs and e-wallets may rise.

The Cryptocurrency Market

The cryptocurrency market is one of the manifestations of the digital payment revolution. Today, various forms of cryptocurrencies are available. The growth in the crypto market leads to an increase in payment apps and VCCs. And, since crypto transactions are online, crypto exchanges deal with virtual payments.

Even in face-to-face transactions, cryptocurrencies have become an option. For example, the Singapore government accepts crypto contracts as a form of payment. For this reason, VCCs and mobile payment apps are now a staple to many. It is no wonder that online payments exceeded cash payments last year.

Key Takeaways

Despite the easing of pandemic restrictions, cashless payments remain a favorite option among many. More and more people in the Asia Pacific are getting access to banks, making VCCs more popular. With the prevalence of online stores and payment apps, VCCs can bridge the gap. It will be no surprise that VCCs are now taking the lead.