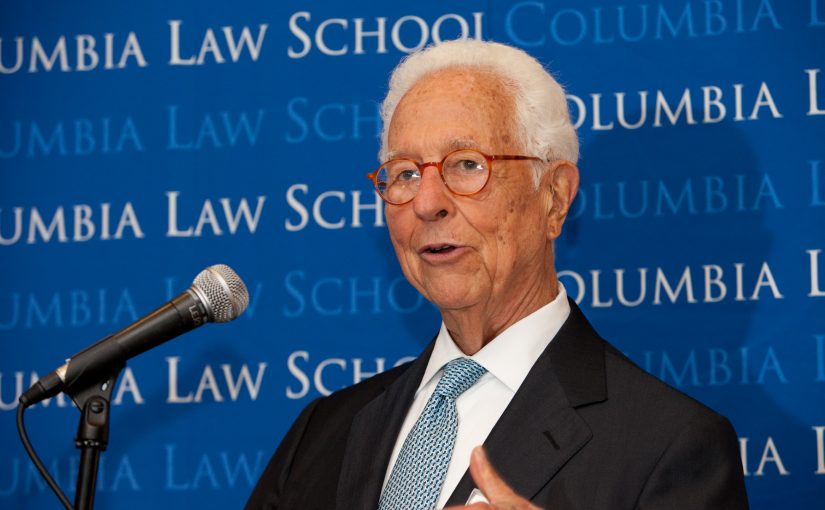

Opening remarks from Ira M. Millstein presented at the Millstein Center’s March 1, 2019 conference, Corporate Governance “Counter-narratives”: On Corporate Purpose and Shareholder Value(s).

While I wish I could personally be with all of you today, I am pleased that so many of you are here to discuss this very important topic.

Today we live, and work, in a very complex and constantly evolving capital market system filled with uncertainty―political uncertainty and economic uncertainty. This means that corporations need to be able to evolve with the changing times.

The corporation has three legs―management, the board of directors and shareholders. Management’s role has been vital from the beginning as the engine of corporate performance, at one time in control. Boards, once passive, are now embracing a more active role in oversight and planning. Over the past decade, a coalescence of economic power has reinvigorated shareholders to become actively involved. Once faceless, groupings of shareholders of different varieties now have more significant concentrated power, particularly the ability and inclination to wield considerable influence over the corporation through its directors.

Today’s reality is that shareholders play a critical role in the longevity of a company. They are the capital on which the corporation thrives. Corporations cannot turn a blind eye to shareholders or their demands for faster and visible so-called shareholder value.

Shareholder value over decades became the shareholder primacy standard which permeated corporate America―the corporation’s purpose was to generate profit for shareholders. It has increasingly been argued that this mindset inhibited growth and innovation to boost shareholder returns in the short term. This mindset is now being challenged.

The challenge is coming from a variety of forces and in unexpected ways by what we will call stakeholders. There is currently growing momentum by a diverse group of stakeholders to think beyond quicker profits. Stakeholders include not only the shareholders but also employees, suppliers, customers and the community from which the corporation draws its resources or that may otherwise be affected by its actions. The most recent proxy season illustrates my point. Proxy demands for governance changes, including the #MeToo movement, gun safety, climate and environmental change, human rights, and the opioid crisis are on the rise. Corporations are being asked to take the lead, the calls won’t go away.

These stakeholder demands cannot be ignored. Rather, they now must be balanced with shareholder demands for short term profits and price swings. It’s a balancing act.

The question for all of us is how do directors strike the right balance? Also, does the current institutional structure, including existing laws, regulations and incentive structures, encourage this balance?

Under our existing legal framework, as long as directors satisfy their fiduciary duties, the law, principally through the business judgement rule, gives directors incredible flexibility. In fact, there are very few situations where director decisions are subject to the more stringent standards of review of enhanced scrutiny or entire fairness. Directors should take solace knowing that they are legally empowered to make decisions they deem to be in the best interests of the corporation―which includes balancing stakeholder demands when appropriate.

But is the current legal framework sufficient for the freedom and protection that directors need to act? Directors and corporations are not immune from the power of the capital markets, the power of shareholders to impact stock price and the ability to raise capital, executive compensation, and a host of other sensitive points.

So, for me, the looming question for all of us is: can we find a way to facilitate, for the corporation, the necessary balance between shareholder value and stakeholder demands which may require shareholders to forego shorter term profit (either temporarily or longer term).

I believe these will be difficult judgment calls, based hopefully on some form of empirics. I have no answer yet for myself, only questions.

First off, management, boards and shareholders will have to be aligned, and this requires deft handling―we can’t afford internecine warfare. This implicates governance. The end result should be good governance. Are we convinced that good governance without empirics will improve corporate performance? Do we need this or is it obvious? Is it necessary? Do we need to consider a different form of governance, e.g., private equity’s? Do directors need to be more and better informed on corporate operations and their extrinsic forces to make informed decisions? Do we need some legislative and/or regulatory changes to accompany private efforts to balance?

There are many more questions, many of which will emerge from this Conference. This Conference, sponsored by The Millstein Center, goes to the core of the Center’s reason for being. Gathering the best and brightest to raise even more important questions and attempt to provide the knowledge to lead to answers, without bias or ideologies. As neutral as possible.