Editor’s Note: This post is part of an ongoing multi-part series covering the Millstein Center’s March 1, 2019 conference, “Corporate Governance ‘Counter-narratives’: On Corporate Purpose and Shareholder Value(s).”

By Brea Hinricks

In his remarks at the Millstein Center’s March 1, 2019 conference, Corporate Governance “Counter-narratives”: On Corporate Purpose and Shareholder Value(s), Delaware Supreme Court Chief Justice Leo Strine argued that a major issue facing public corporations and capitalism today is that they are failing to work for the average person (a recurring theme in the Chief Justice’s recent writings).

Mark Roe, in reflecting on Strine’s work for the conference, identified another main narrative espoused by Strine: that “short-termism” is a deep problem which is damaging the U.S. economy. Indeed, the short-termism story is pointed to by many in the legal, political, and business realms as a major threat to economic prosperity. Commentators from Joe Biden to Warren Buffet and Jamie Dimon have argued that there is a problematic pressure on companies to prioritize short-term profits over long-term, sustained growth, in part due to more intense focus from activist investors.

Despite this widespread rhetoric, Roe argues that economy-wide data simply doesn’t provide clear support for the short-termism story. He identifies four main trends often put forth as evidence of the bad economic effects of stock market short-termism:

- cutbacks in capital expenditures;

- stock buybacks which starve firms of cash;

- reduced R&D investment resulting from the lack of cash (which, in turn, reduces employee welfare); and

- a U.S. stock market that does not support longer-term innovation.

Roe looks at the data behind each of these trends in turn and argues that they are either not supported or cannot be well explained by the short-termism narrative.

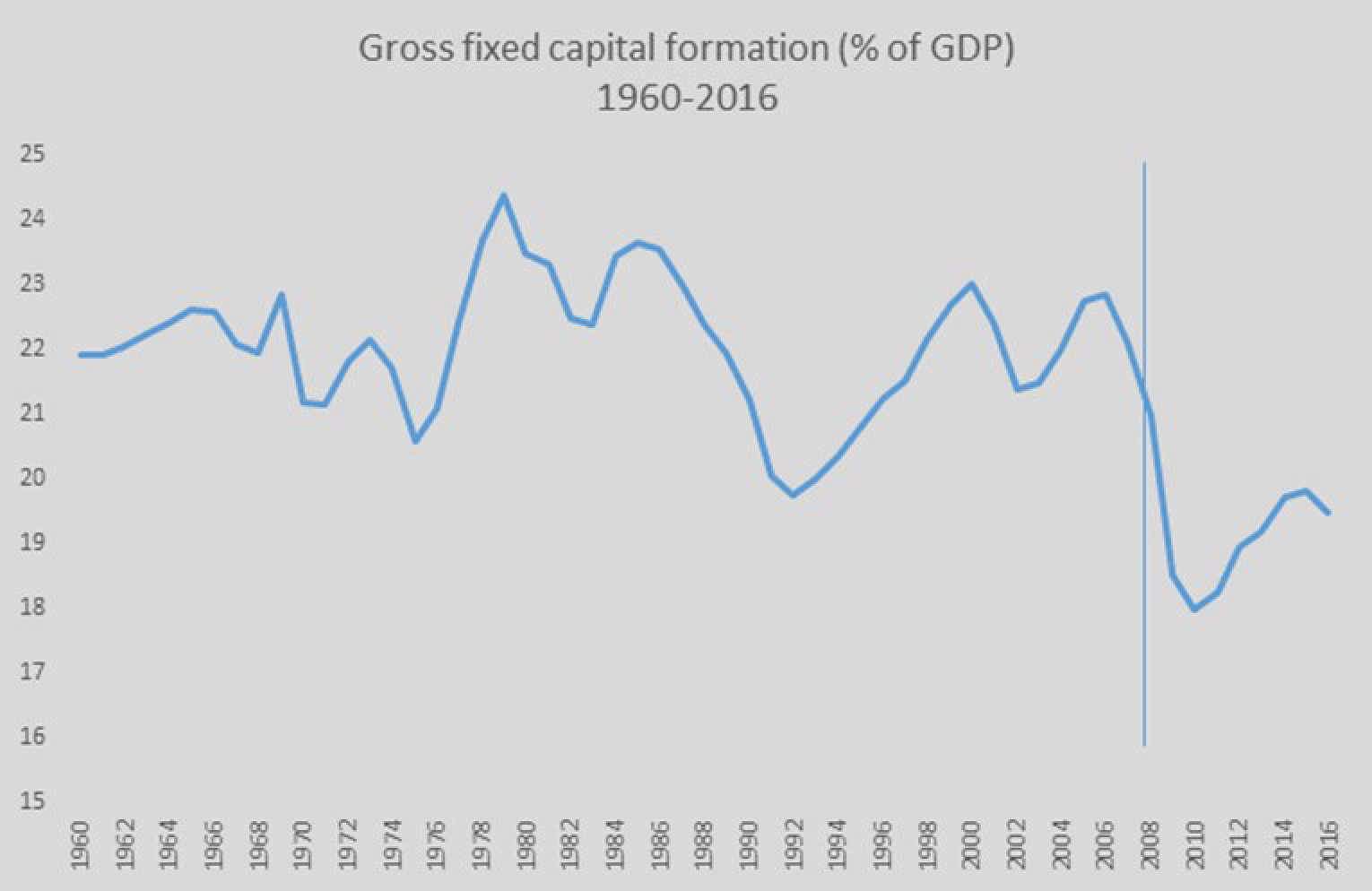

Roe acknowledges that the data show capital expenditures declining globally since 2009. The dominant hypothesis explaining this trend is that stock-market trading and activist interventions have caused short-term interests to take precedence over longer-term investments in CapEx. However, there are other possible explanations, including a generally weakened economy since the financial crisis, the continued movement of basic manufacturing outside the U.S. to China, or the fact that today’s 21st century advanced economies use fewer hard assets and more intangibles than in the past (or they use existing capital equipment more efficiently).

Source: The World Bank. Gross fixed capital formation (% of GDP). World Bank national accounts data, https://data.worldbank.org/indicator/NE.GDI.FTOT.ZS?end=2016&start=1960&view=char (accessed Jan. 8, 2018).

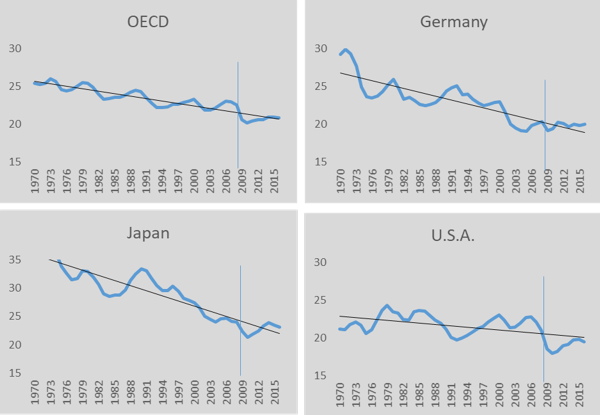

Source: the World Bank National Accounts, Gross fixed capital formation (% of GDP), https://data.worldbank.org/indicator/NE.GDI.FTOT.ZS?end=2016&start=1960&view=char (accessed Jan. 2, 2018). Standard and Poor’s did a similar comparison, reproduced in Appendix Figure 7, showing North American capital expenditures moving in tandem with the rest of the world’s.

Roe points out that this trend is occurring everywhere in the developed world, even in nations lacking strong stock markets and shareholder activism. Capital expenditures are declining more sharply in the rest of the OECD than in the U.S., despite the U.S. economy’s extremely close ties to stock market performance. Given these differences and the plausible alternative explanations, Roe maintains that the stock market is not the likely culprit of the decline in CapEx.

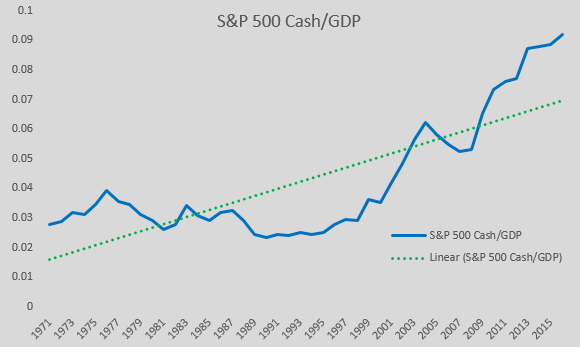

The conventional wisdom in the short-termism narrative says that hedge fund activists target firms with “excess cash” and force payouts, buybacks, and other applications of cash. Roe concedes that this pressure exists, and that the data indeed show an increase in buybacks. However, he identifies an important concurrent trend of rising levels of net long-term borrowings at the same rate of increase, indicating that firms are recapitalizing and replacing equity with debt (which has been “cheap” at low or no interest rates since 2009). In light of this trend, Roe says, we should be concerned with the ability of weakly capitalized firms to endure the next recession, and that increased buybacks are only one side of the coin. He also notes that cash overall in the S&P 500 as an overall percentage of GDP has been increasing in spite of these trends (though it is possible cash levels would even higher in the absence of increased buybacks).

Source: The compustat database was the source for the buyback data. Compustat Industrial (Annual Data), Standard & Poor’s (accessed various dates in Jan. 2018). Retrieved from Wharton Research Data Service.

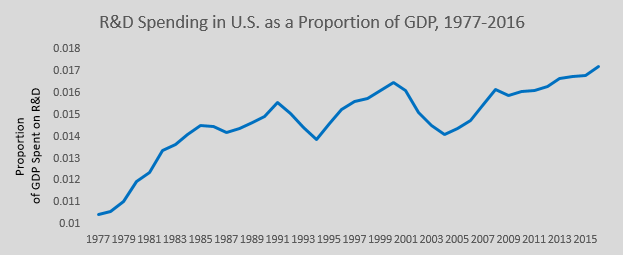

Roe next argues that the data simply does not show that R&D expenditures are decreasing due to hedge fund activism. Instead, R&D in the U.S. has been increasing, and has been doing so noticeably more sharply than GDP growth. Again, he notes that it is possible that the rate of R&D would be even higher in the absence of short-termist pressures, but this is difficult to measure.

To round out his case that we shouldn’t be as concerned about short-termism as the conventional wisdom suggests, Roe makes an intuitive point: if it really were the case that the U.S. markets were unfriendly to long-term oriented firms, then the most successful companies would be short sighted and far-sighted companies would be worse off. However, he points out that the largest companies by market capitalization are Apple, Amazon, Microsoft, Alphabet, and Facebook ― companies he argues are very future oriented.

Why, then, do we see such a large gap between the data and the rhetoric around short-termism? Roe argues that it relates to the first theme identified by Chief Justice Strine. There is a growing sentiment that capitalism and corporations are failing the average worker, and the short-term pressures of activist investors provide a tidy explanation for the root cause of the problem. It is easier for policymakers and the media to criticize activist hedge funds, Roe explains, than it is to criticize the capitalist system as a whole or shareholders generally.

The problem, Roe says, is that using short-termism as a scapegoat could lead to misdirected remedies. For instance, if we believe short-termism is a deep problem, one remedy might be to give boards and management of companies even more discretion than they currently have. But it is not clear that this solution would address some of the other sources of today’s discontent with capitalism, such as wealth and income inequality.

In place of short-termism, Roe encourages us to consider alternative causes of the trends we are seeing today. For instance, the increased corporate concentration in the U.S. over the last 25 years could be leading to reduced competition, which in turn could be causing companies to decrease their investment in assets. Similarly, the deductibility of interest and cheap debt could be encouraging companies to increase their debt holdings, leaving them weakly capitalized and ill-positioned to face the next recession.

Whether these explanations are correct or whether the causes of today’s issues will be found elsewhere, Roe implores us to pay attention to what the data are telling us rather than what popular narratives and conventional wisdom would have us believe.

See here for more on Chief Justice Leo Strine’s remarks at our March 1 conference. A full recording of Mark Roe’s remarks (made as part of a larger panel discussion) are available here.

For more on why the short-termism picture may be incomplete, see “Long-Term Bias,” a paper by Millstein Center Co-Director Eric Talley and Michal Barzuza.