Editor’s Note: This post is part of an ongoing multi-part series covering the Millstein Center’s March 1, 2019 conference, “Corporate Governance ‘Counter-narratives’: On Corporate Purpose and Shareholder Value(s).”

By Brea Hinricks

Is corporate governance a primary cause of the current economic malaise plaguing the U.S. and other parts of the world? Could changes to corporate governance, including a shift by corporations toward serving a broader “corporate purpose” (beyond a myopic focus on short-term shareholder profits), help improve economic growth? These were key questions posed at the Millstein Center’s March 1, 2019 Counter-Narratives Conference.

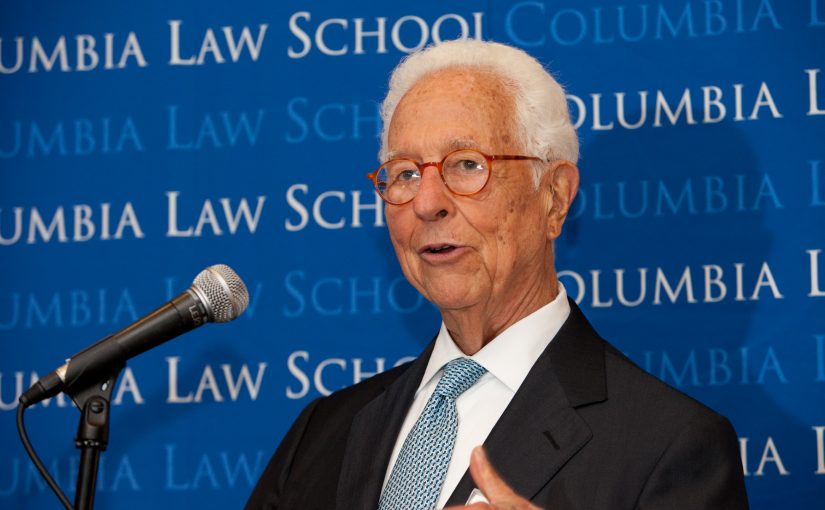

According to Columbia Business School’s Bruce Greenwald, the answer is emphatically “no.” Instead, a much broader and more systemic force than corporate governance is to blame: a structural economic downturn caused by slow productivity growth.

Professor Greenwald argues that we are in the middle of a depression caused by a global economic transition in the nature of work. As in previous downturns, we are facing the collapse of a once-important and central sector (manufacturing) and another (service) taking its place. In some ways, this is similar to the transition that led to the Great Depression, where we moved from a farming and agricultural-based society to an industrial society, but with some key differences.