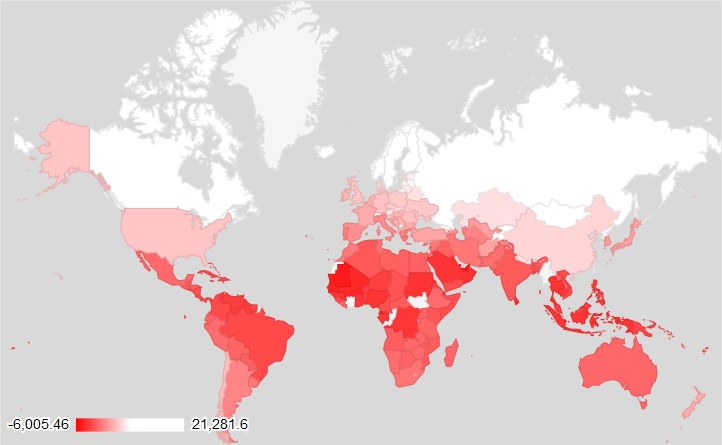

Graph 1: Overall climate change losers

Introducing financing climate change mitigation through bonds to be paid back by future generations through taxation is a means to raise funds for offsetting the losses of global warming. As a novel way to amend individual saving preferences in favor of future generations, Sachs (2014) proposes to mitigate climate change by debt to be repaid by tax revenues on labor income in the future. In a 2-period model, one generation works in period 1 and retires in period 2. Part of the disposable wage income is saved for consumption in the second period. CO2 emission mitigation imposes immediate costs onto current generations and reduces wages. Greenhouse gas concentrations in period 2 are determined by the emissions in period 1. Wages of the young in the second period are reduced by climate change dependent on greenhouse gas levels. Disposable labor income of the young equals market wage net of taxes. Leaving the current generation with unchanged disposable income allocates the burdens of climate change mitigation across generations without the need to trade off one generation’s well-being for another’s.

While today’s young generation is left unharmed, the second period young generation is made better off ecologically. The bonds solution should be pursued in climate change loser countries, in order to offset the costs for climate change in a more intergenerationally harmonious way. Since the majority of GDP contributing factors is losing in climate change loser countries, future generations should be serving as last resort to pay for climate stability. While future generations enjoy a favorable climate and averted environmental lock-ins; the current populace does not face drawbacks on economic growth (Puaschunder, 2017). All generations are better off with mitigation through climate bonds as compared to the business-as-usual (BAU) non-mitigation scenario (Sachs, 2014).

Governments in loser countries should receive tax transfers in the present from the winning countries. Since here borrowing equals loans or issuing of bonds to be paid back by future generations, the government must pay back debt plus interest payments by raising taxes on later generations. Taxing future generations is justified as for the assumed preferences of future generations to avoid higher costs of climate change long-term damages and environmental irreversible lock-ins. Overall this tax-and-transfer mitigation policy thus appears as a Pareto-improving fair solution across the world and generations.

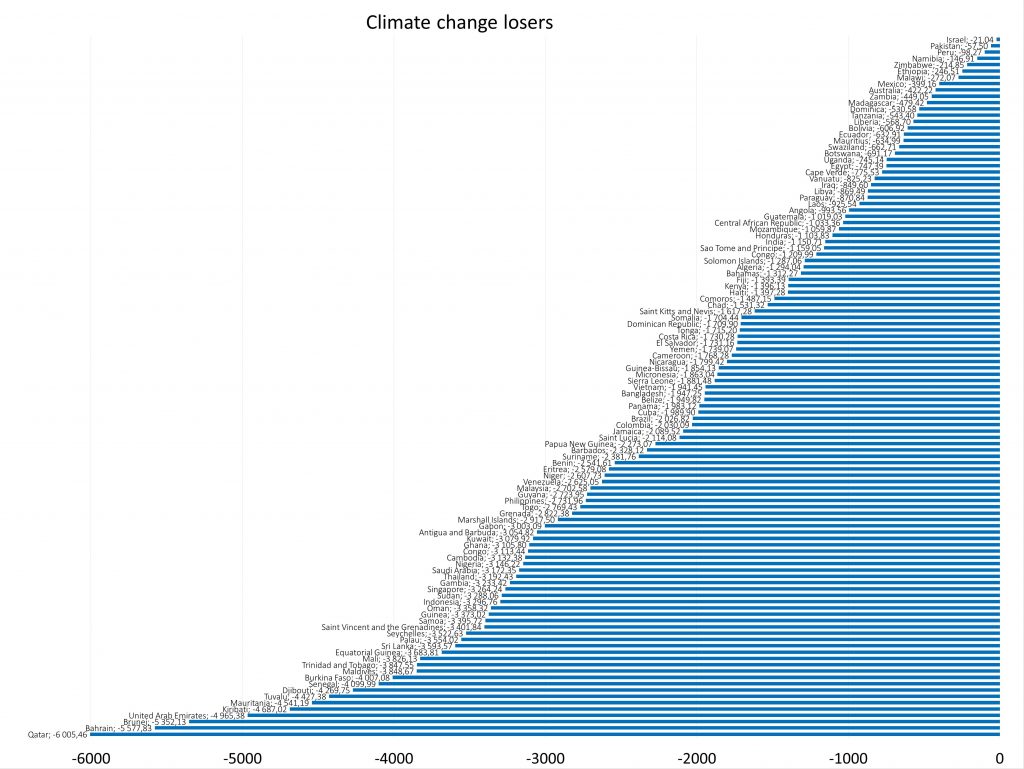

Graph 2: Climate change losers weighted by GDP/capita