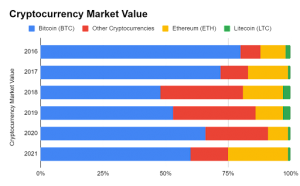

Recently, the price of a single Bitcoin broke $60,000. Meanwhile, the cumulative market value of all cryptocurrencies climbed up to $2 trillion. Crypto’s promise of a system beyond government control captured our imagination. Despite its volatility, the market continues to see an influx of traders.

Here, we will look at the ways the tech sector is responding to the cryptocurrency revolution.

How the Tech Sector is Adapting to the Rise of Crypto

The crypto market has changed the financial order and transactions across industries. Given its digital nature, the tech sector was one of the first ones to reap its rewards. Large tech companies like Google, Telegram, and Facebook entered the market in 2019. From trading to the retrieval of stolen cryptocurrencies, growth continues to drive innovation. Below are some of the ways the tech sector is adapting amidst the boom in the crypto market:

Blockchain-Based Search Trends

A blockchain is a digital ledger containing crypto transactions. With SAP (Systems, Applications, and Products) software, you can create your own blockchain.

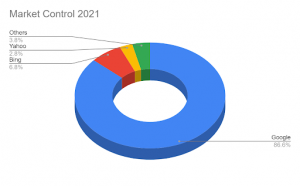

The importance of blockchain led Google to come up with a clever idea. In 2019, it designed a blockchain-based search engine.

Now that most transactions are online, this search engine tool is becoming appealing. It allows browsers to find the top eight blockchains. Given its scalable nature, it works best when it comes to transparency. But, innovations are still underway since it poses security threats.

Crypto Theft Control

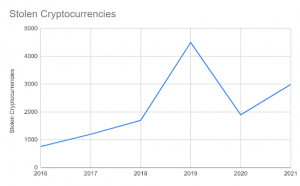

In 2016-2018, the value of stolen cryptocurrencies rose from $760 million to $1.7 billion. In 2019, it alarmed users across the globe as the value reached $4.5 billion. With the entry of messaging apps like Telegram, the threat may increase further. Many people are aware that it has its fair share of scam accounts. But, it continues to take huge steps towards the market.

Over the past decade, the total stolen cryptocurrencies amounted to $19.2 billion. In 2020, it decreased to $1.9 billion, although it remained higher than the average of $1.6 billion. But as of August 2021, incidents were in an upsurge again as the value was almost $3 billion. Daily crypto thefts today amount to $10 million on average.

But, the effort to track crypto transactions is not futile. For example, Bitquery is a blockchain search engine in New York. It produces software to underpin analytic tools related to data and law firms.

The tracking starts by searching all the flagged crypto addresses and their transactions. From there, it will generate graphs that show how cryptocurrencies circulated. Hence, it can identify the patterns that may point to hacker accounts. This is possible because it can reveal the IP address of the hackers.

Last June, the FBI recovered $2.3 million in BTC ransom from those who hacked Colonial Pipeline. With blockchain technology, they traced the ransom payments to track the culprits. Moreso, KuCoin recovered almost all the $281 million stolen cryptocurrencies. The alleged suspects were North Korean hackers.

Payment Systems are Changing

Companies in the tech sector are gearing towards cryptocurrency payments. As such, more investments across different regions are getting in line with the digital revolution. For example, in Singapore, there are crypto contract payments in some government agencies. People in the crypto world now know the country as the new cryptocurrency and blockchain hub.

With its openness to cashless payment systems, it is conducive for crypto transactions. Some government agencies are using Ethereum contracts for payments and other transactions. Moreso, investments are matching its robust financial market growth. As such, wire transfers, e-wallets, and VCCs are becoming more popular. Companies in the financial services industry are racing towards the crypto trend.

For instance, Spenmo raised $34 million in a Series A investment round. This company is famous for providing corporate cards and e-payments. These include Virtual Credit Cards or VCCs. With this, transactions in the ASEAN region may become more efficient. Even when running out of cash on hand, purchases and monthly payments are still possible. Hence, the goal to convert credit cards to cash is almost at hand.

Also, a study shows that over 80% of individuals will have access to credit cards, VCCs, and e-wallets in 2025. In the same survey, 74% of respondents are open to doing transactions through e-payments.

In Conclusion

The cryptocurrency market is growing and will not falter anytime soon. With increased investments, it will tap more potentials across different regions. There are still risks, but innovations may limit them and improve user experience. More forms will emerge, thus expanding and spurring growth in the tech sector.