Editor’s Note: This post is part of an ongoing multi-part series covering the Millstein Center’s March 1, 2019 conference, “Corporate Governance ‘Counter-narratives’: On Corporate Purpose and Shareholder Value(s).”

By Brea Hinricks

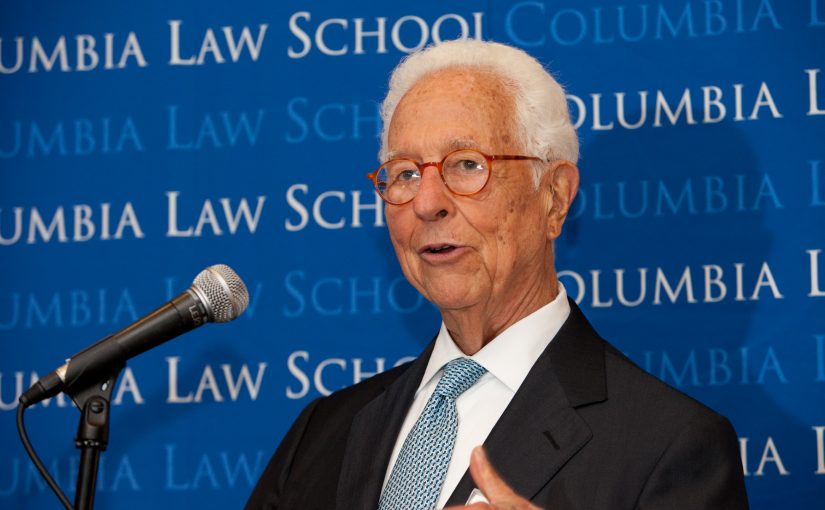

Professor Jeff Gordon presents his argument for addressing the economic insecurity faced by today’s employees—a robust government investment program in human capital to subsidize employee retraining and reeducation.

Capitalism and corporate purpose have evolved over the last half century to become increasingly and more narrowly focused on profits and shareholder value. The Friedman Doctrine has firmly taken hold. At the same time, the rise of global product and capital markets have subjected firms to increased competitive pressures, and domestic disrupters in the U.S. such as Walmart, Amazon, Netflix, and the large tech companies have transformed entire industries and resulted in a more dynamic and less predictable domestic economy. The rise of asset managers and index funds have allowed shareholders to hold globally diversified equity portfolios at a low cost. A “high-powered” corporate governance regime has emerged in which managerial performance is closely monitored through shareholder value metrics, and activists tolerate only minuscule amounts of slack. Firms are encouraged to engage in more risk-taking and less diversification of cashflows at the firm level (which is inefficient given shareholders’ diversified portfolios across firms), resulting in shorter company lifespans.

Continue reading The Government ‘Match’ to High-Powered Corporate Governance